how to calculate sst malaysia

Service Tax required to be accounted-. A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

Vat Sst Registration In Malaysia 2022 Procedure

The SST has two elements.

. For example if the declared value of your items is 500 MYR in order. The Honourable Finance Minister during the budget 2011 speech had announced that the rate of service tax will. Sales Tax 5 for fruit juices basic foodstuffs building materials.

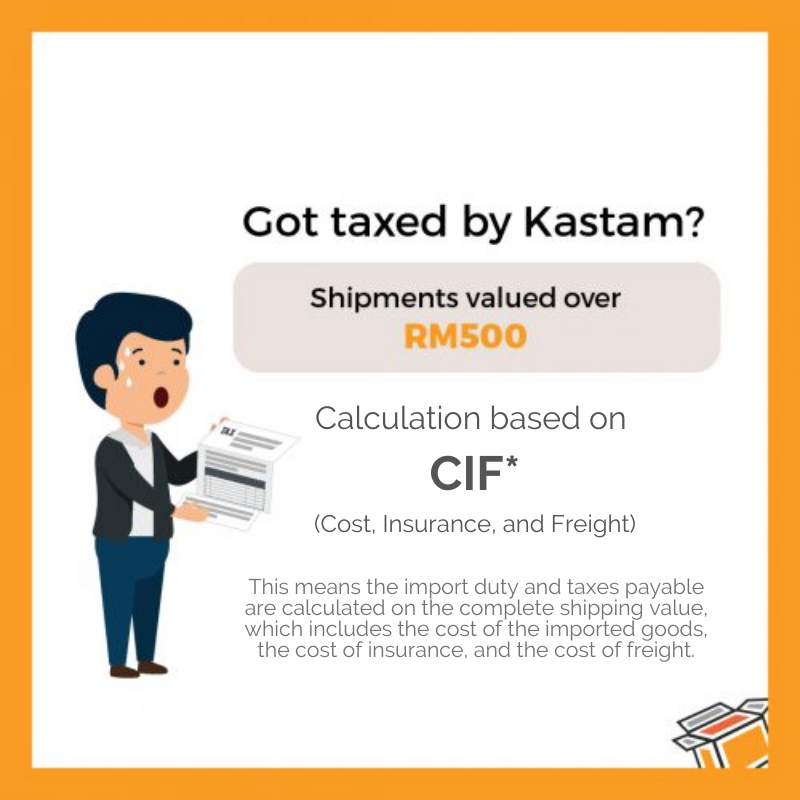

300 006 18 GST amount. A service tax that is charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business and a single stage. The Tax Free Threshold Is 500 MYR If the full value of your items is over 500 MYR the import tax on a shipment will be 10.

300 is GST exclusive value. SST is an ad-valorem tax that is calculated through percentage in proportion to the estimated value of the sales or services. Sunway Serene Sales Gallery Jalan SS 82 47301 Petaling Jaya Selangor Opposite Western Digital.

Under the SST tax regime the range of taxable items and. In the main dashboard of Deskera Books click on the Products on the. Sales and service tax Malaysia.

Automated calculations Calculate sales tax on each line item in your invoices quotes purchase orders and bills. Somewhere along the continuum of 0 6 and 10 depending on the proportion of stuff that is taxed at 0 at 6 and at 10 respectively. 21st December 2022 Hotel Armada PETALING JAYA Selangor Malaysia Objective of Understanding Malaysian Sales and Service Tax training.

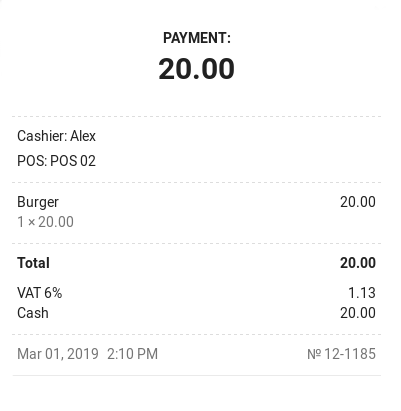

Price before tax and price are rounded. This again renders the phrase 10. When an invoice is issued to the customer.

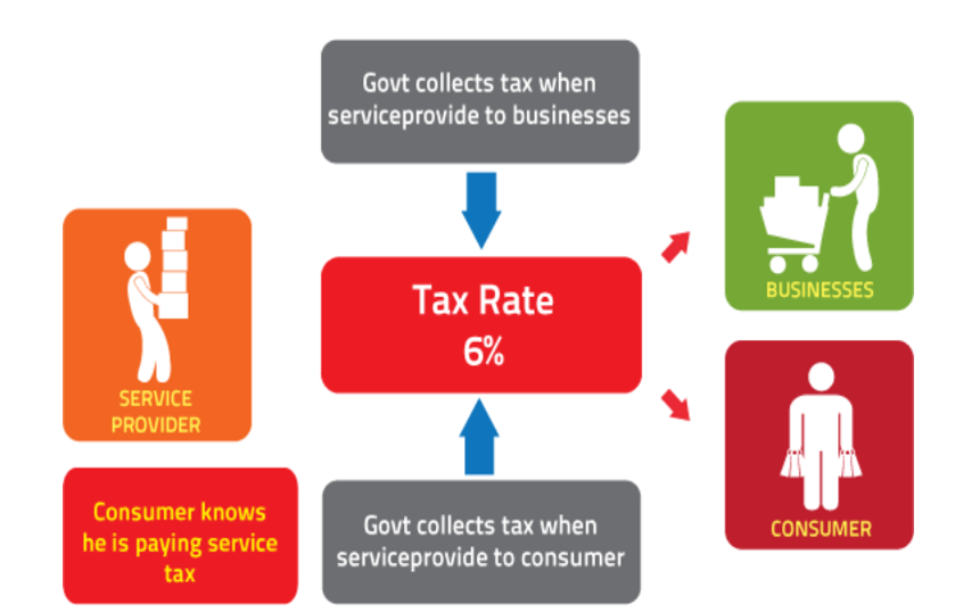

The current tax rate for sales tax is 5 and 10 while the service tax rate is 6. Just multiple your GST exclusive amount by 006. It consists of two parts.

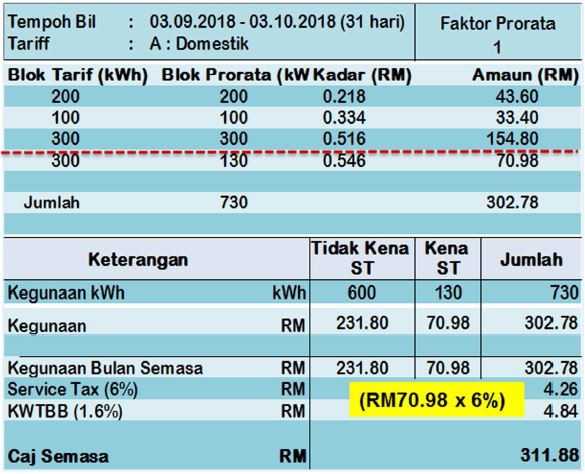

The rates of SST stand at 10 for sales tax and 6 for services tax that charge on the final production and service only. 4 RATE OF TAX SALES TAX RATE OF TAX ORDER 2018 5 10 RM000lit 5 - reduced sales tax rate First Schedule in the Order 10 - default sales tax rate Specific rate for petroleum. A 10 tax charged on all taxable goods manufactured in and imported.

SST is a tax on the consumption of goods and services consumed within Malaysia. Service Tax will be levied on Paid Television Broadcasting Services. On the day following period of twelve month when any whole or part of the payment is not received from the date of the invoice for the taxable service.

SST in Malaysia was introduced to replace GST in 2018. To calculate Malaysian GST at 6 rate is very easy. How to calculate sst malaysia On the day following period of twelve month when any whole or part of the payment is not received from the date of the.

The tax rate selected for each item is used to calculate sales tax Sales tax on. Preparing for GST audit. Malaysian SST sets the time of supply the date at which the tax becomes applicable as the earlier of the following three points.

How to calculate sst malaysia SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific. Fill in tax and price - and get price before tax as result. If your company is already GST-registered the.

AMOUNT RM SUBTOTAL RM GST RM TOTAL RM GST RATE. Service Tax 6. Sales Tax 10.

10 6 5 Tax calculator needs two values. To calculate GST value based on the salespurchase value. How to Set Up Malaysia Tax.

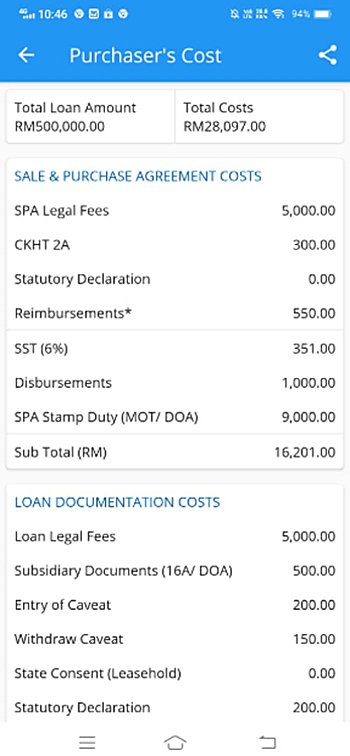

Sale And Purchase Agreement In Malaysia 4 Important Clauses To Note

Malaysia Sst Sales And Service Tax A Complete Guide

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

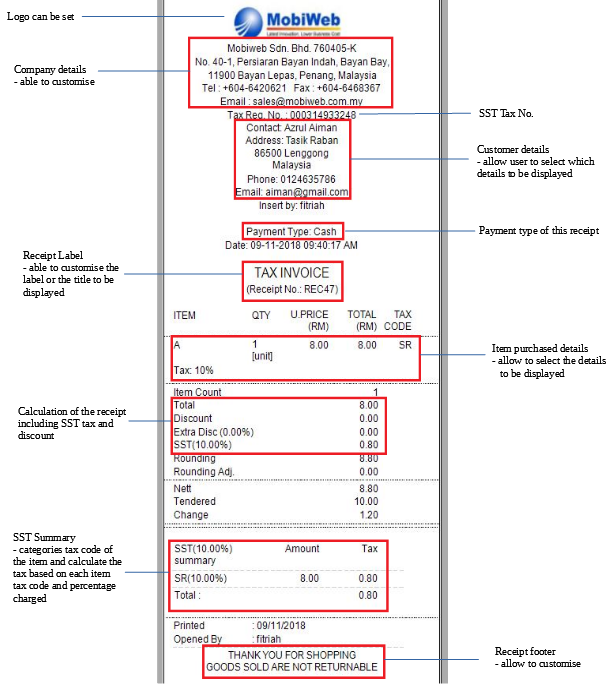

Sales And Service Tax Invoice Sst Tax Malaysia Tax Posmarket Pos System

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

All You Need To Know About Sst Malaysia Yh Tan Associates Plt

Sst Simplified Malaysian Service Tax Guide Mypf My

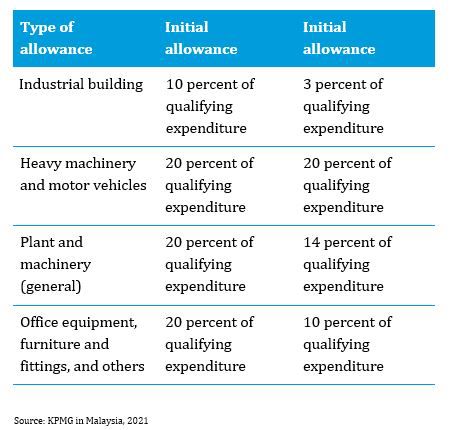

Malaysia Taxation Of Cross Border M A Kpmg Global

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

What To Expect If Your Buyandship Shipment Gets Taxed By Kastam Buyandship Malaysia

How To Calculate Stamp Duty In 2022 Stamp Duty Waiver For First Time House Buyer

Malaysia Sst Sales And Service Tax A Complete Guide

All You Need To Know About Sst Malaysia Yh Tan Associates Plt

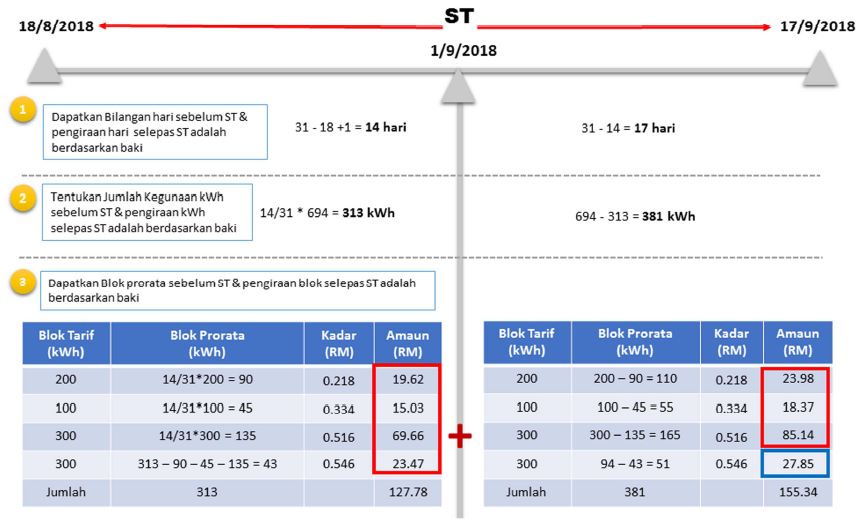

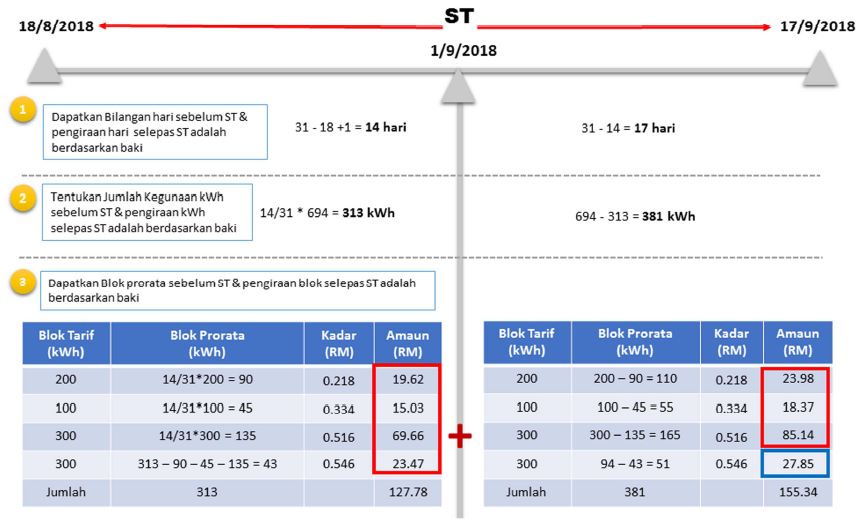

9 Does Tnb Charge Service Tax On Non Residential Customers

9 Does Tnb Charge Service Tax On Non Residential Customers

0 Response to "how to calculate sst malaysia"

Post a Comment